sales tax on leased cars in texas

In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor vehicle sales and use tax. 3 If a motor vehicle for which the tax has not been paid ceases to be leased for use primarily for farming and ranching including the rearing of poultry and use in feedlots or timber operations the owner shall notify the comptroller on a form provided by the comptroller and shall pay the sales or use tax on the motor vehicle based on the.

I Want To Sell My Car Quick Things To Consider Sell Used Car Electric Cars For Sale Cars For Sale

For vehicles that are being rented or leased see see taxation of leases and rentals.

. This page aggregates the highly-rated recommendations for Texas Taxes On Leased Vehicles. Like with any purchase the rules on when and how much sales tax youll pay. The other party has traded up and must pay motor vehicle tax on the 10000 difference.

The most common method is to tax monthly lease payments at the local sales tax rate. We hope this article helped answer questions you may have regarding motor vehicle tax responsibilities for a Texas resident who purchases a leased vehicle. If you dont have a trade then youre simply paying taxes on selling price.

Texas sales tax on car lease texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me. Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes 2000006251250. Texas is the only state that still taxes the capitalized cost of a leased vehicle.

I leased a vehicle at the end of 2019. In the state of Texas you pay 625 tax on Trade difference Example. Total sales tax paid in texas 625 under current interpretation 2500.

Motor Vehicle Sales Tax Rule 370 Motor Vehicle Leases and Sales. Using our Lease Calculator we find the monthly payment 59600. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Motor Vehicle Sales Use and Rental Tax. Only the service is charged tax.

Texas Tax Code Chapter 152 Taxes on Sale Rental and Use of Motor Vehicles. Any rentals for less than thirty days are considered to be subject to a gross rental receipts tax at the rate of 10. Howeverm i did fill out a 50-285 affidavit and submitted with my lease paperwork.

Sales tax is a part of buying and leasing cars in states that charge it. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. They are the choices that get trusted and positively-reviewed by users.

If Sally trades her 30000 motor vehicle in a private-party transaction for a vehicle worth 20000. They are the choices that get trusted and positively-reviewed by users. For rental contracts of 30 days or less the tax rate is 10 percent of the gross rental receipts.

In another state for the same vehicle same price and same tax. The sales tax for cars in Texas is 625 of the. In other states generally only the monthly lease payments are taxed similar to the new law in Illinois.

Didnt receive a tax bill for that year. For more information visit our Web site. Read real discussions on thousands of.

Sally owes no motor vehicle tax because a trade-down has occurred. According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax. No tax is due on the lease payments made by the lessee under a lease agreement.

This page aggregates the highly-rated recommendations for Texas Car Lease Sales Tax. Many times manufacturers have programs to offset this by paying the sales tax amount for the lessee those would be a good time to start a lease. Hi in Texas do you have to pay sales tax on a leased vehicle upfront.

F A lessee may take credit for legally imposed sales use or similar tax paid to another state by the lessee or the lessor on. Texas Sales Tax is a transaction tax so sales tax is paid at the time of the lease inception cap cost and rolled into the monthly lease payments. This means you only pay tax on the part of the car you lease not the entire value of the car.

In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. For contracts of 31 to 180 days the tax rate is 625 percent of the gross rental receipts. Sally owes no motor vehicle sales tax on her trade-down of vehicles.

If the lessee is a new resident of this state as described in 371 of this title relating to Definition of Resident and New Resident the new resident may pay a new resident use tax of 90 imposed by Tax Code 152023 in lieu of the 625 use tax. Some dealerships may charge a documentary fee of 125 dollars. If the vehicle you are purchasing has Tax Credits from the manufacturer LM then your tax rate.

Any tax paid by the lessee when the motor vehicle was titled and registered in. The 625 percent motor vehicle sales tax at. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle. However if you rent out the leased equipment without operating it yourself a sales and use tax applies.

Hi in Texas do you have to pay sales tax on a leased vehicle upfront.

How Much Is Tax Title And License In Texas The Freeman Online

Consider Selling Your Car Before Your Lease Ends Edmunds

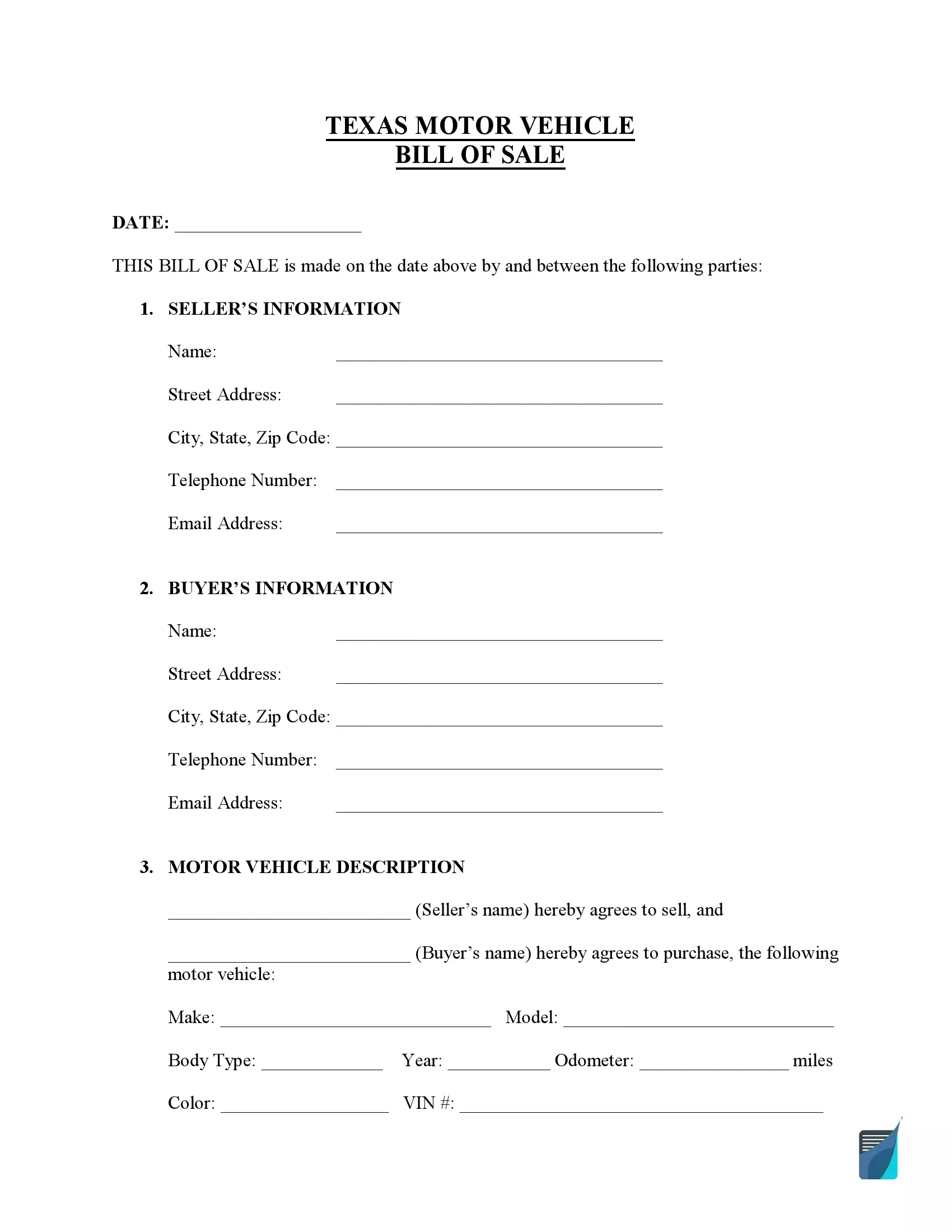

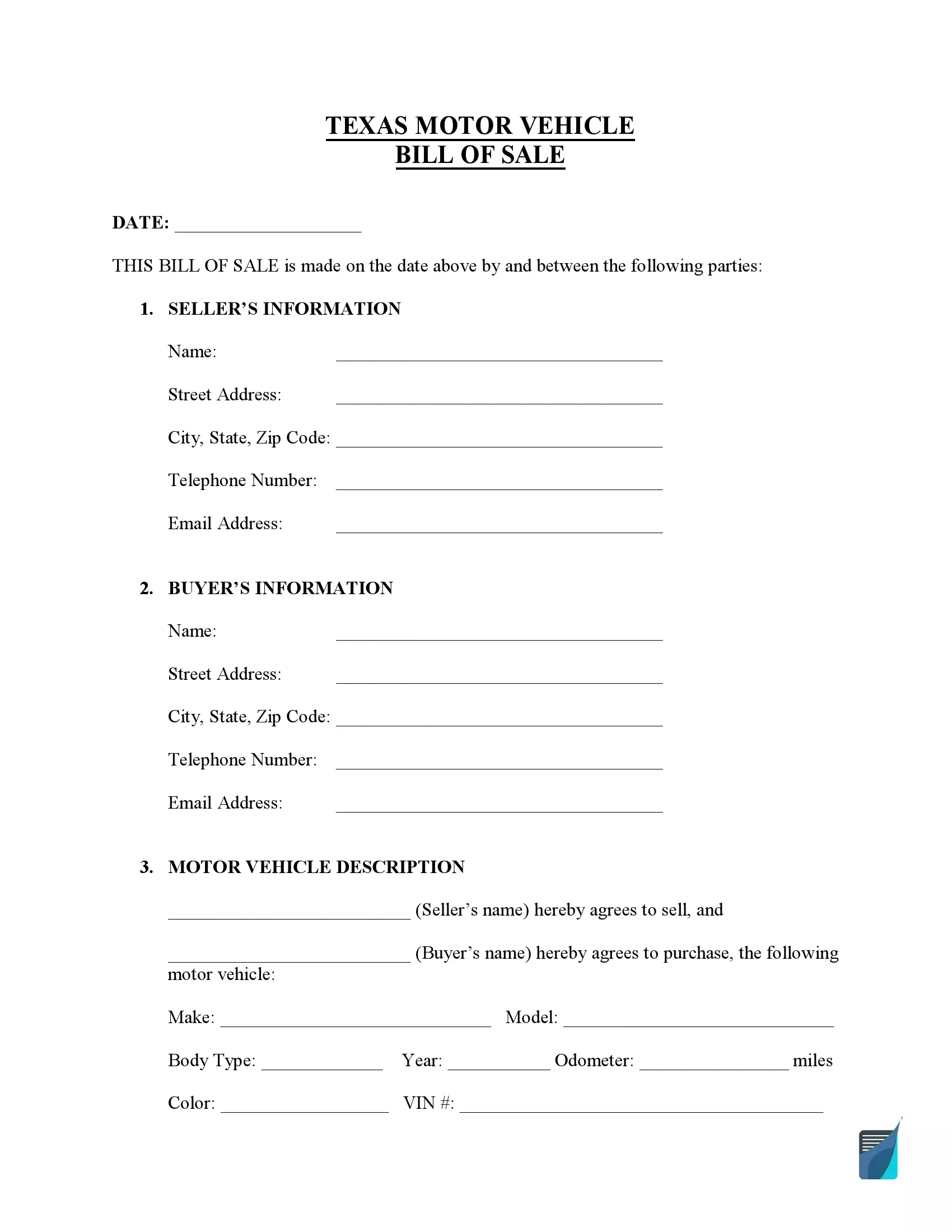

Free Texas Vehicle Bill Of Sale Form Pdf Formspal

Auto Sales Are Down Here S Why They Ll Continue To Fall Cars For Sale Car Auctions Car

Nj Car Sales Tax Everything You Need To Know

Used 2018 Kia Optima Sx Texas Direct Auto 2018 Sx Used Turbo 2l I4 16v Automatic Fwd Sedan 2020 Is In Stock And For Sale 24carshop Com Kia Optima Fwd Sedan

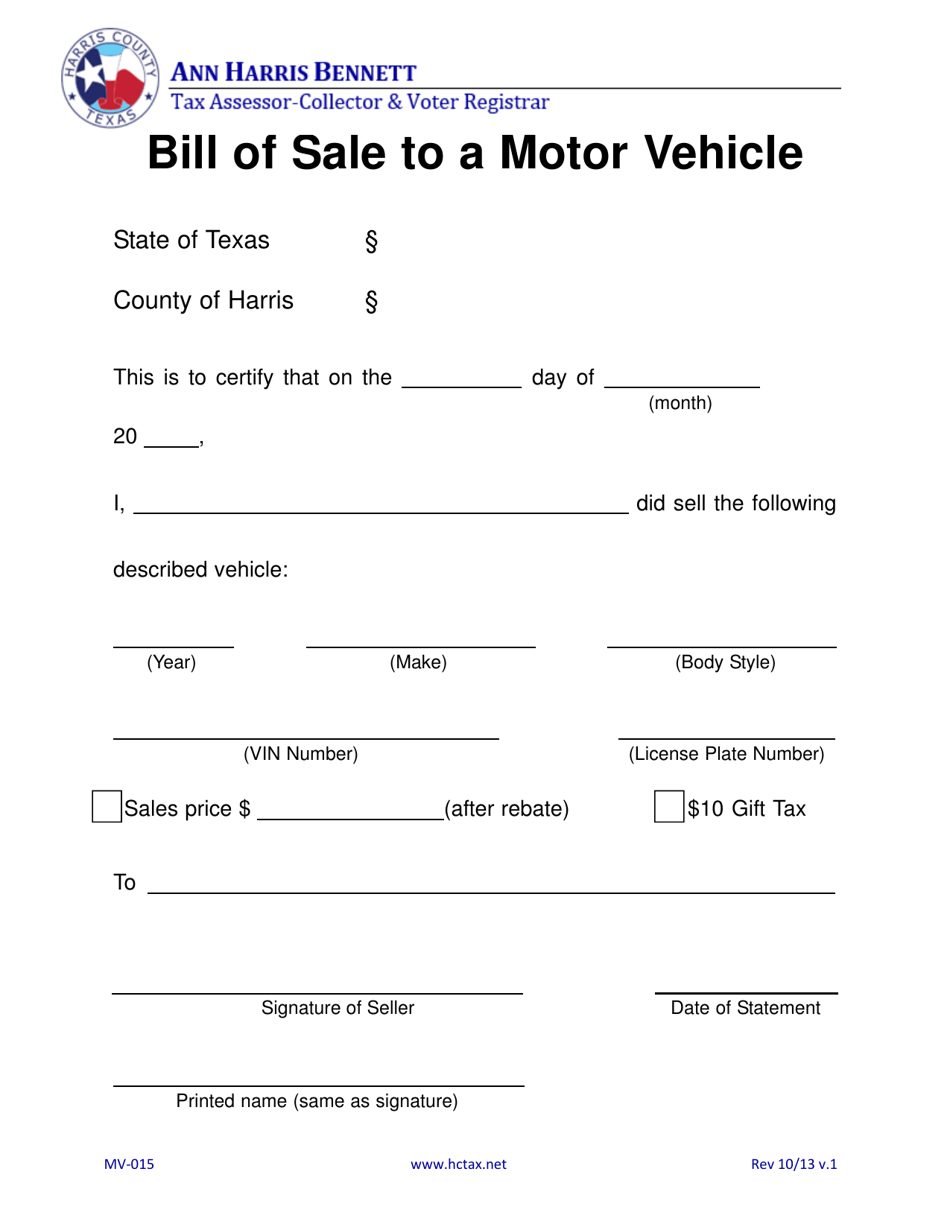

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller